By Christopher Rugaber AP Economics Writer

Washington (AP) — Chair Jerome Powell said Thursday that the Federal Reserve will likely cut its key interest rate slowly and deliberately in the coming months, in part because inflation has shown signs of persistence and the Fed’s officials want to see where it heads next.

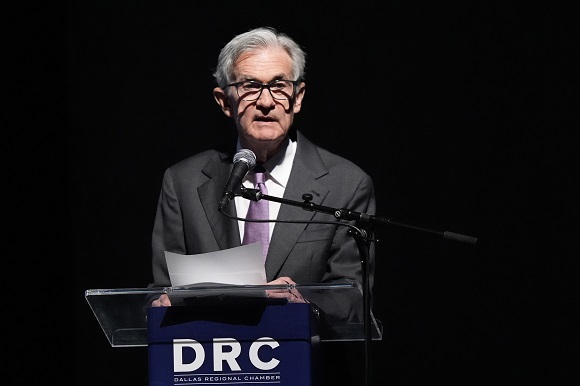

Powell, speaking in Dallas, said that inflation is edging closer to the central bank’s 2% target, “but it is not there yet.”

At the same time, he said, the economy is strong, and the policymakers can take time to monitor the path of inflation.

“The economy is not sending any signals that we need to be in a hurry to lower rates,” the Fed chair said. “The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.”

Economists expect the Fed to announce another quarter-point rate cut in December, after a quarter-point reduction last week and half-point cut in September.

But the Fed’s steps after that are much less clear. In September, the central bank’s officials collectively signaled that they envisioned cutting their key rate four times in 2025. Wall Street traders, though, now expect just two rate reductions, according to futures pricing tracked by CME FedWatch. And after Powell’s cautious remarks Thursday, traders estimated the likelihood of a Fed rate cut in December at just below 59%, down from 83% a day earlier.

The Fed’s benchmark interest rate tends to influence borrowing rates across the economy, including for mortgages, auto loans and credit cards. Other factors, though, can also push up longer-term rates, notably expectations for inflation and economic growth.

For example, Donald Trump’s presidential election victory has sent yields on Treasury securities higher. It is a sign that investors expect faster growth next year as well as potentially larger budget deficits and even higher inflation should Trump impose widespread tariffs and mass deportations of migrants as he has promised.

In his remarks Thursday, Powell suggested that inflation may remain stuck somewhat above the Fed’s target in the coming months. But he reiterated that inflation should eventually decline further, “albeit on a sometimes bumpy path.”

Under questioning, Powell also explained why he considers the Fed’s role as an independent federal agency to be crucial to its ability to fight inflation. During his first term, Trump threatened to try to fire Powell for not cutting interest rates. And during this year’s election campaign, Trump asserted that as president, he should have a “say” on the Fed’s rate policies.

Powell said Thursday that the Fed’s independence from political concerns has made the public confident that the policymakers will keep inflation low over time. That confidence, in turn, has helped reduce inflation after it had spiked in the wake of the pandemic. When consumers and businesses expect inflation to slow, they act in ways that help hold it down — by, for example, not demanding high cost-of-living raises.

“The public,” Powell said, “believed that we would get inflation down, that we would restore price stability. And that’s ultimately the key to it.”

Powell declined to comment on other political topics, including the potential impacts of Trump’s proposals to impose sweeping tariffs and implement mass deport

Other Fed officials have also recently expressed uncertainty about how much more they can cut rates, given the economy’s steady growth and the apparent stickiness of inflation.

As measured by the central bank’s preferred inflation gauge, so-called core prices, which exclude volatile food and energy costs, have been stuck in the high 2% range for five months.

On Wednesday, Lorie Logan, president of the Fed’s Dallas branch, said it was not clear how much more the Fed should cut its key short-term rate.

“If we cut too far … inflation could reaccelerate and the (Fed) could need to reverse direction,” Logan said. “I believe it’s best to proceed with caution.

Notes from APS Radio News

During the pandemic period, a number of the world’s central banks embarked on massive programs of monetary expansion, starting in late February and early March of 2020.

For its part, between the early part of March of 2020 to over a year later, the US Federal Reserve added over $4 trillion to its holdings, by purchasing billions of dollars’ worth of Treasury bonds and corporate bonds each month during that period.

As well, at that time it kept interest rates rather low.

Other central banks, including the Bank of Japan and the European Central Bank, followed similar policies.

In addition, during that period many countries engaged in lockdowns; many small and medium-sized businesses and enterprises were shuttered by way of orders issued by public health officials, politicians and various administrators.

One of the direct causes of those shutdowns was the development of shortages.

According to a number of economists, the combination of shortages of various goods and services and massive programs of “quantitative easing” led to substantially higher rates of inflation.

In consequence of shuttered economies and higher rates of inflation in the first world, less developed countries suffered greatly, due, in part, to shortages of supplies and due to lowered demand.

Price gouging also took place, further increasing inflation rates during that period.